Emmerson Resources has built a highly prospective exploration portfolio of projects covering 1,706 km2 in the Northern Territory and 659km2 in the Macquarie Arc of NSW.

Incorporated on 10 November 2005 and subsequently listed on the ASX on 17 December 2007. The company’s head office is in Perth, Western Australia. Emmerson is led by a group of experienced Australian mining executives including former BHP Billiton and WMC executive Rob Bills as the Managing Director and CEO; Former Mount Isa Mines and WMC mining executive Andrew McIlwain as Non-Executive Chairman; Dr Allan Trench, a Non-Executive Director with a geology/geophysical background and extensive experience in strategy, project development and operations within the natural resource sector; and Alan Tate, a Non-Executive Director with extensive experience as a commercial and finance leader.

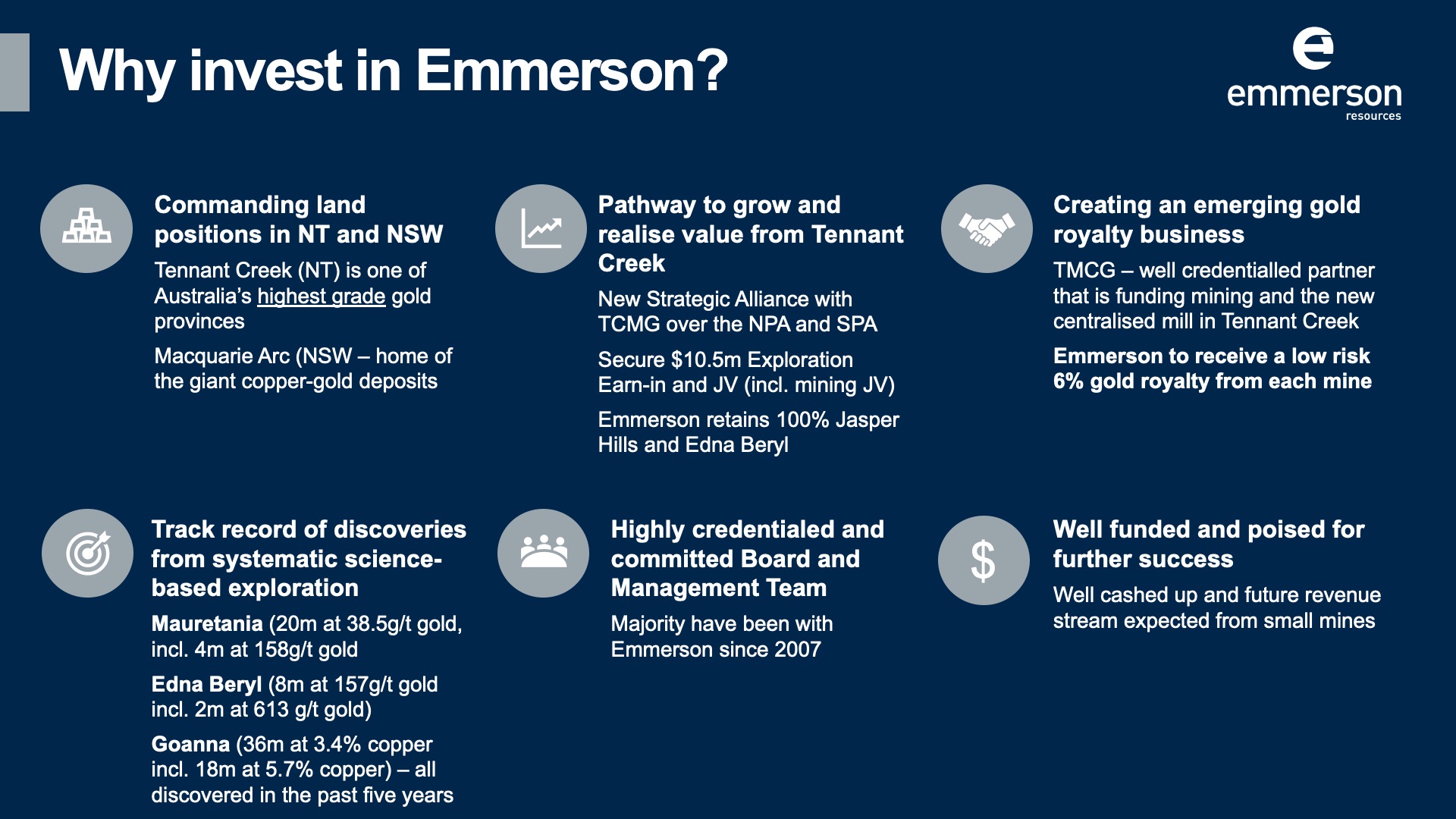

At a glance: Emmerson Value Proposition – a unique suite of assets

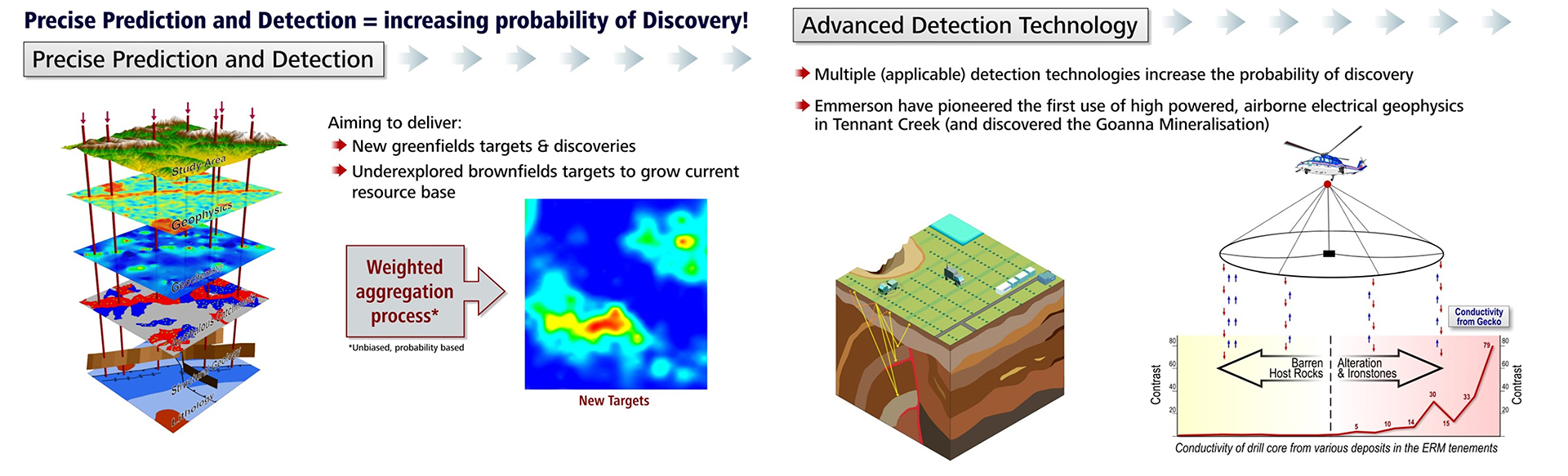

The largest creation of shareholder value comes from the discovery of mineral deposits. Whilst there are many pathways to discovery, Emmerson strongly believes in utilising the best science and business practice to increase the probability of success. Most critical to discovery is ensuring exploration is focused only in the most prospective geological belts. As such, Emmerson has utilised proprietary 2D and 3D predictive targeting models that are aimed at increasing the probability of discovery from analysing multiple, independent layers of data.

The area selection process provides ranked targets that are then subject to systematic exploration. Emmerson also partners with those research institutes and consultants that are at the forefront of understanding the respective geological belts and deposits. Moreover, our exploration programs are conducted within a business framework consisting of various stages, gates (success criteria) and budgets – ensuring the exploration funds are directed into only the very best opportunities.

Our Strategy

Superior value from a strategy of discovery, mining, and production.

Our Projects

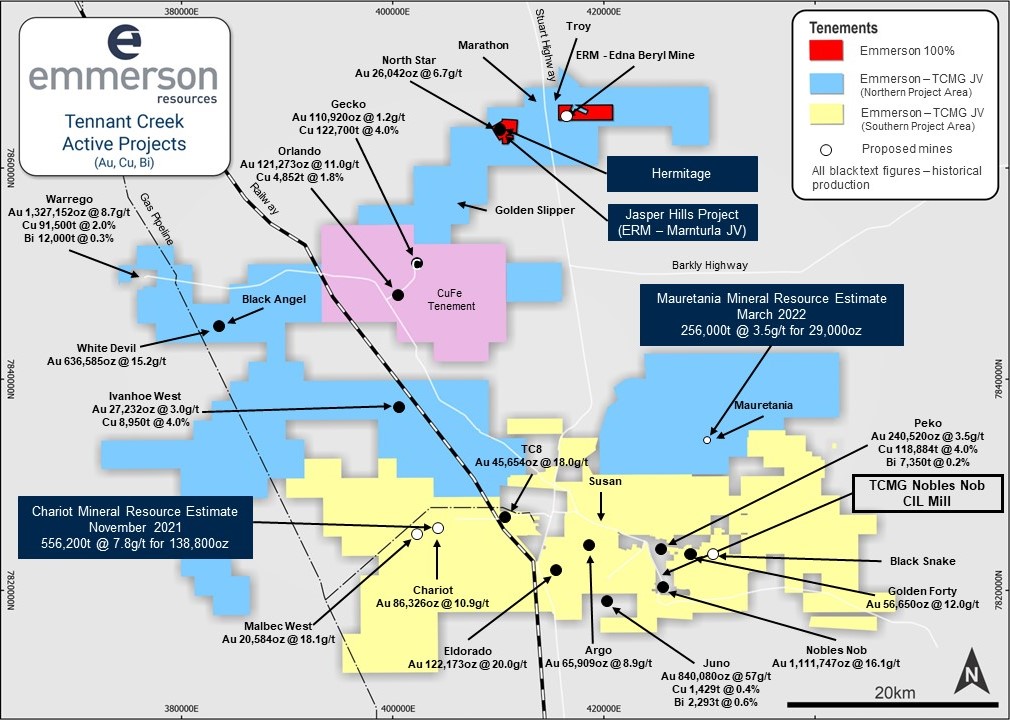

Tennant Creek

Emmerson has consolidated a large land package in one of Australia’s highest-grade gold fields – the Tennant Creek Mineral Field (TCMF) in the Northern Territory. The field is renowned for high grade, high margin deposits and is where Emmerson has been conducting modern innovative exploration. To date, this has resulted in several new discoveries - the first discoveries in the field for over a decade.

Emmerson’s vision is to continue to leverage our exploration expertise and extensive experience in the Tennant Creek Mineral Field in making further high value mineral discoveries, whilst establishing a low-risk emerging royalty business. Thus providing a sustainable path to grow shareholder wealth.

Emmerson's Tennant Creek Project showing Joint Venture Ground and potential mines (white dots) that are undergoing advanced studies. Noting the Jasper Hills Project is a joint venture between Emmerson and the Traditional Owners (Marnturla Native Title Agreement).

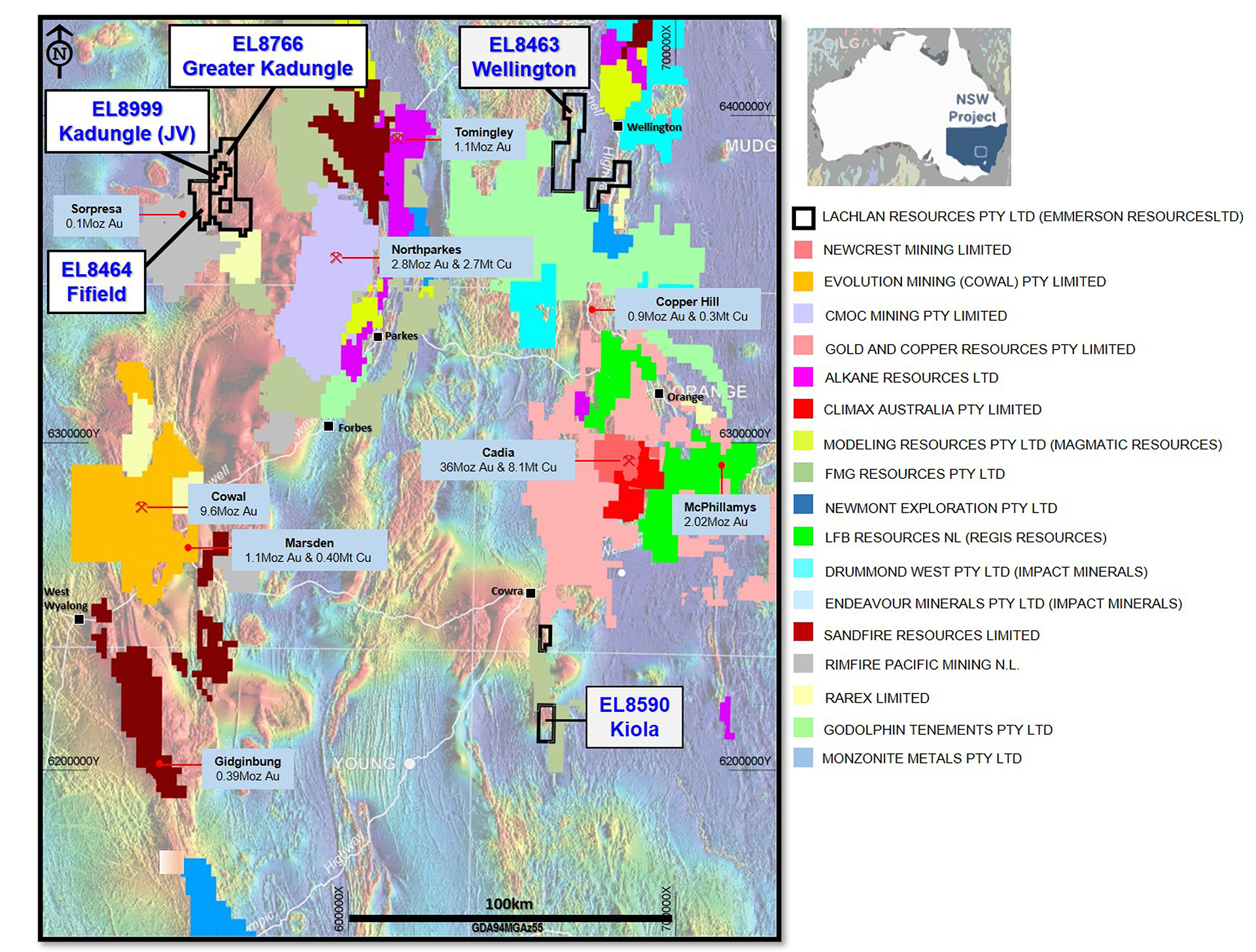

NSW Projects

Emmerson identified the Macquarie Arc in NSW back in 2015, as a world class copper-gold geological belt that for a variety of reasons is under- represented in terms of new discoveries relative to its known metal endowment and geological potential . Emmerson and strategic alliance partner Kenex Limited commenced a very detailed analysis of the attributes of this belt, culminating in the application of large ground positions that are highly prospective for both porphyry copper-gold and epithermal gold-silver deposits (applied under Emmerson’s subsidiary company Lachlan Resources).

The metal endowment of the Macquarie Arc (in NSW) hosts >80Mozs gold and >13Mt copper with these resources heavily weighted to areas of outcrop or limited cover. Emmerson’s five exploration projects contain many attributes of the known deposits within the Macquarie Arc but remain under explored due to historical impediments, including overlying cover (farmlands and younger rocks).